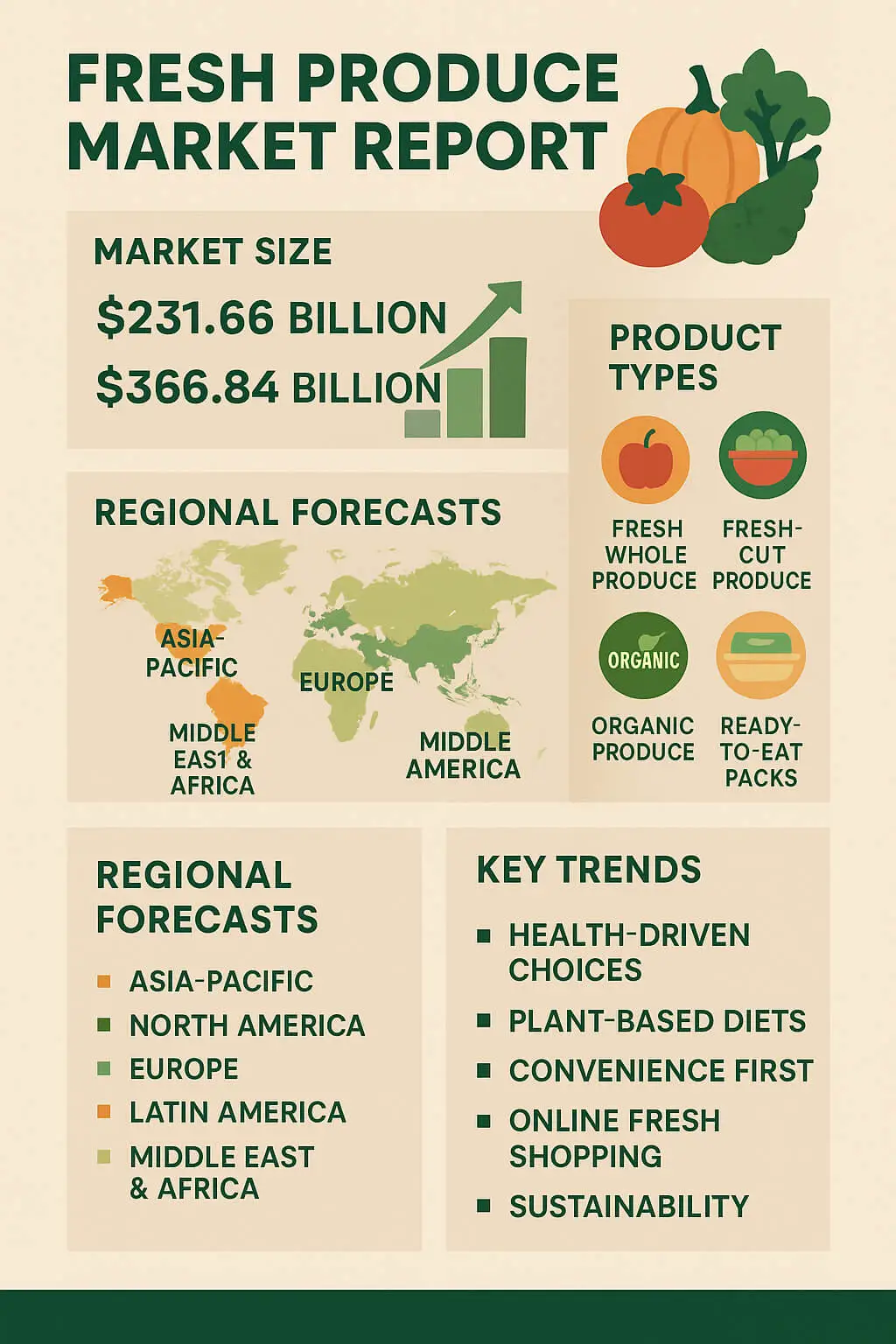

The world fruit and vegetable industry is expanding. NEW INDUSTRY: See below About the latest research, the fresh produce market was valued at USD 231.66 billion in 2024. And is anticipated to reach USD 366.84 billion by 2033, at a CAGR of 5.24 %. This is for all of fresh produce and if we include frozen, canned, processed etc, the all market was worth 761.56 billion USD in 2024 and will grow beyond 1 trillion USD in 2030. Described in this fresh produce market report are the size and regions of the global produce trade, as well as its trends and future.

What Is Fresh Produce?

Fresh produce refers to raw or minimally processed fruits and vegetables. Plastic wrap also wraps fruits (whole and cut fresh), salad packs and bulk vegetables in supermarkets or markets. It is not frozen, canned or dried. Fruit and vegetables are generally highly perishable and tend to be sold and consumed within a very short time from harvest.

Customers purchase fresh produce on a daily basis. It is one of supermarkets’ biggest categories in the world. Fresh food is associated with health, freshness, and natural diets. This is the reason this market, even in a lay motion, grows even during an economic crisis.

The fresh produce market was more than USD 231 billion in 2024. And by 2033, that number is projected to exceed $366 billion. Gains are fairly uniform in all global regions. The total market for fruits and vegetables, inclusive of frozen, canned, dried and otherwise processed fruit and vegetables, was worth USD 761.56 billion in 2024. It is estimated to be USD 680.78 billion by 2025 to USD 1,018.12 billion by 2030, at a CAGR of 5.1%.

A separate projection for which food service, industrial uses and processed foods are included shows the entire produce market could hit $5.65 trillion by 2034.

Growth drivers include:

Rising demand for healthy foods

Urban population growth

Shift to plant-based eating

Innovation in packaging and supply chain

Expanding modern retail in emerging markets

Types of Fresh Produce Products

Fresh produce includes many sub-segments. These are the main product groups:

Fresh Whole Produce

This is the largest segment. It covers sliced apples, bananas, onions, potatoes, carrots and other fruits and vegetables that are sold whole. These are sold in the loose coin or sleeves.

Fresh-Cut Produce

This segment is growing fast. This includes cut fruits, prepared salad mixes, cut veggie sticks and peeled products. These usually come in pans, clamshells, and pouches.

Organic Produce

Organic fruits and vegetables are raised without artificial chemicals. They’re prevalent in Europe and North America, but they are more expensive than the common stuff.

Ready-to-Eat Packs

These can be such snacks as fruits you break open and eat, vegetables you can microwave or pre-packaged meals you can eat hot or cold. They are a hit with young urban consumers.

Major Regions

Asia-Pacific

This is the world’s largest fresh food region, after all. China and India are the largest producers and users. Vietnam, Indonesia and the Philippines are also expanding rapidly. In these countries, the retail infrastructure is growing.

North America

The U.S. and Canada are major markets for both fresh and enhanced produce. Supermarkets, clubs and e-commerce channels are the top distributors. Organic, fresh-cut and convenience items are in high demand.

Europe

Germany, the UK, France and the Netherlands are among the key markets. Sustainable, certified and origin labels matter for the European buyer. Many of the imports come from Spain, Morocco and Turkey.

Latin America

The main players are Brazil, Chile and Mexico. They are also among the biggest exporters to the U.S. and EU in many Latin American countries. Domestic use is increasing.

Middle East and Africa

They are growth areas because populations are growing there. Most fresh food is distributed through wet markets and more informal, small shops, though larger supermarkets are growing.

Consumer Trends

Health-Driven Choices

Fresh produce is selling better than ever because it is associated with good health. Fruits and vegetables are valued for their contributions to immunity, digestion and fitness.

Price Sensitivity

Shoppers were also being cautious, as global inflation kicked in during 2024 and 2025. Some customers shifted from organic to conventionally grown products. Others cut fresh-cut spending.

Plant-Based Diets

People are eating less meat and more vegetables. All of which is aiding in the rise of fresh produce — especially protein-packed ones like beans, lentils, mushrooms and leafy greens.

Convenience First

City dwellers crave quick and easy meals. Fresh cut, peeled or prepared vegetables are a hit, particularly in the cities where the young professionals reside.

Online Fresh Shopping

E-commerce is growing in produce. And many purchasers now order fruit and vegetables online. Supermarkets and apps provide same-day delivery in many major cities.

Supermarket Trends

Retailers are making major changes to keep fresh produce profitable:

Larger produce sections: Supermarkets are expanding space for fruits and vegetables.

Local sourcing: Many chains now source from local farms to reduce transport time.

Private label growth: Supermarkets are launching their own brand of fresh produce packs.

Eco-packaging: Retailers are replacing plastic with paper or compostable trays.

Data-driven planning: Some retailers now plan their produce inventory using software or AI.

For example, Coles Supermarkets in Australia moved from a 10-day produce planning cycle to a 12-week forecast model. This helps reduce food waste and stabilise supply with growers. In the UK, Tesco is testing vertical farms to reduce transport distance and increase freshness.

Supply Chain Innovation

The fresh produce supply chain is becoming smarter and faster:

Cold chain expansion: Refrigerated trucks and storage are increasing in developing countries.

Blockchain traceability: Some retailers can now show where and when fruit was harvested.

Robotics and AI: Machines now sort and grade produce, reducing the need for manual labor.

Vertical farming: Some chains use indoor hydroponic systems to grow leafy greens near stores.

These changes are helping supermarkets reduce shrink (loss from waste) and offer fresher items on the shelf. They also help protect food safety.

Supply Chain Improvements

Modernization of produce from farm to shelf by retailers

Forecasting and AI Planning

Some supermarket chains are now using A.I. to predict weeks in advance what they will need in produce. This aids in minimizing overstock, spoilage. For instance, one piece of software can help predict demand for salad greens or berries based on matching weather patterns with previous sales.

Vertical Integration

More and more, retailers are getting involved in the farming process. Some own greenhouses. Others work directly with growers. This helps to manage freshness, cost, and availability.

Cold Chain Expansion

Investment is being directed to refrigeration systems. Despite the nature of some of the emerging regions, cold chains are now widespread. Perishable fruits such as mangoes, berries, and avocados have their life extended when placed into cold storage.

Regional Sourcing

From distant imports to nearby farms. By way of example, UK supermarkets are now sourcing more British than imported food. Inside Southeast Asia, more produce is kept.

Focus on Sustainability

Sustainability is shaping every part of the produce market.

Eco-farming methods: More farms are using low-carbon fertilisers and sustainable practices.

Carbon tracking: Some supermarkets now label produce with the carbon cost of production.

Plastic-free packaging: Paper trays, compostable films, and loose produce are replacing plastic.

Reduced transport: Supermarkets are cutting food miles by growing closer to the city using indoor farming or greenhouses.

Retailers like Tesco are leading this shift by adopting LEAF certification for their global produce supply. This covers farming impact, water use, pesticide control, and biodiversity.

Retailer Case Studies

Tesco (UK)

Tesco is investing in vertical farming, eco-packaging, and clean sourcing. They are testing controlled-environment farms that reduce water, pesticides, and emissions.

Coles (Australia)

Coles shifted its planning cycle from 10 days to 12 weeks. This gives growers better demand signals. It also reduces unsold stock and leads to more stable supply.

Walmart (US)

Walmart is using blockchain for produce traceability. In some stores, customers can scan a QR code to see the farm origin of their apples or spinach.

Lidl (Germany and Europe)

Lidl is expanding its private label fresh produce. It promotes regional sourcing and uses eco-friendly designs for in-store displays.

Regional Forecasts

Asia-Pacific

This is the biggest region for growth. Urbanisation, rising incomes, and changing diets are increasing fruit and vegetable demand. India, China, Indonesia, and Vietnam are key markets.

North America

High per-person spending on produce continues. Organic, fresh-cut, and snacking vegetables are popular. Online orders for fresh items are also growing.

Europe

Sustainability leads the market. EU rules require origin labelling, low-carbon farming, and packaging reforms. Shoppers prefer local, organic, and seasonal produce.

Latin America

Production and exports are strong. Brazil, Mexico, and Chile export to Europe and the U.S. Domestically, demand is rising for fresh-cut and convenience packs.

Middle East & Africa

Modern retail is expanding. Supermarkets are building cold chains and training suppliers. Demand is growing with population growth and urbanisation.

Challenges Facing the Industry

Even with growth, the fresh produce sector faces real problems.

Price Pressure

Many fruits and vegetables up have become more costly because of inflation. Shoppers now skip over luxury products such as organic berries or tropical fruits.

Labour Shortages

People are needed to pick fresh fruits and vegetables. A lot of farms have difficulty getting workers. This is still limited to larger farms, with some using robots.

Climate Change

Yields are damaged by extreme heat, floods, and droughts. In some areas, full harvests are lost to weather. Lack of water is one of the most serious threats.

Waste and Shrink

Fresh fruits and vegetables spoil easily. Retailers and distributors can be out of pocket for stock they cannot sell or has been damaged. Smarter planning is needed.

Infrastructure Gaps

Poor roads and storage do the same to the value chain in low-income areas. Your produce may get spoiled even before hitting the stores. This limits growth.

The Future of Fresh Produce

Looking ahead, the market will continue to grow. The global fresh produce sector is expected to reach over USD 366 billion by 2033, based on current growth. The broader produce industry (including frozen, dried, and processed items) may surpass USD 5.6 trillion by 2034.

Key future drivers:

Urban consumers demanding fast, healthy, local produce

Retailers investing in digital supply chains and AI

Shoppers choosing eco-friendly, low-carbon food

Online grocery expanding into fresh categories

Governments supporting farm sustainability and food safety

Sectors like fresh-cut vegetables, salad kits, organic fruit, and pre-packed healthy snacks will lead growth. So will indoor-grown greens and vertical farming systems.

Final Outlook

The following fresh produce market report indicates that fruits and vegetables continue to be central to the international food market. Demand is strong. Innovation is growing. However, it also has to cope with pressure — inflation, labour shortages, climate risk and evolving shopper behavior.

We need to find a better system to supply and deliver, and that should be done collaboratively — by the retailers, suppliers, and growers. The next ten years will be defined by smart planning, short transport and better forecasting

At over USD 231 billion worldwide for fresh produce alone — and trillions when wider categories are accounted for — this market will continue to influence food trends, supermarkets plans and consumer diets in all corners of the globe.