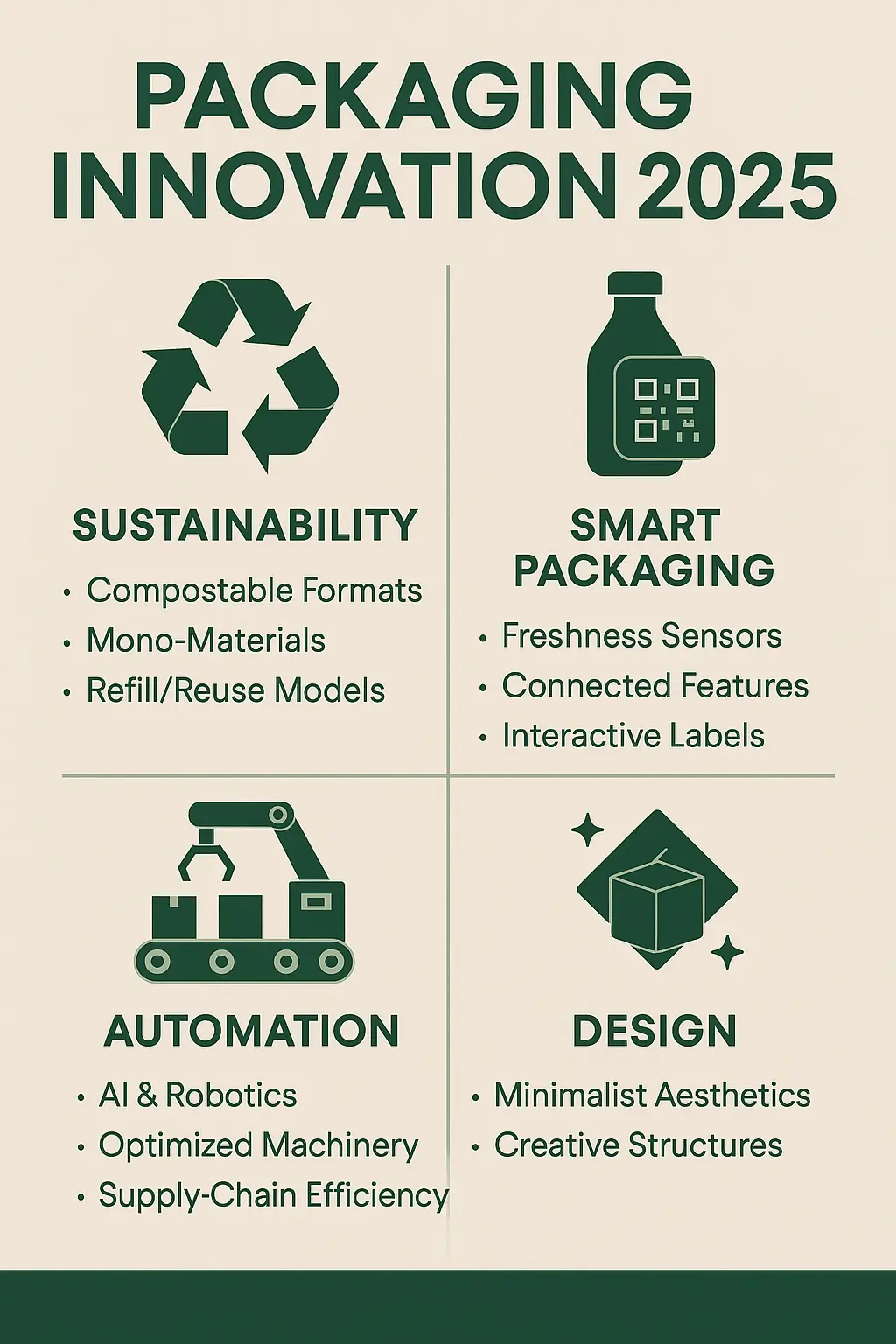

Packaging Innovation 2025 is transforming the way consumer products are manufactured, transported, and even sold in the market. Fresh materials, new construction equipment and rules are necessitating a rethink on design and performance. Sustainability, automation, and digital characteristics are not cherry on top anymore, they are turning into an essential aspect.

The transition is across all the areas, including food, beauty, online purchases, and home furniture. The reason as to why firms are changing their packaging is due to shortage of materials, restrictions on plastic wrappings and the emergence of new customer desires. The future direction will be greener materials, connected packaging and systems that use less and do more.

The Packaging Innovations 2025 Event

The industry made a huge step at the Packaging Innovations & Empack 2025 exhibition in NEC Birmingham. It was the largest of its type thus far and this time it had some 450 exhibitors and in excess of 7,000 visitors. Event facilitated a look into new laws, technologies and material breakthrough.

The show featured three areas that included core packaging, machinery and automation and contract-manufacturing. Visitors were presented with a view of what the future of packaging in the food, drink, cosmetics, pharma, retail and logistics might look like. These were circular economy design, compliance with new producer requirements and smart supply chain solutions.

Sustainability: The Core of Innovation

The biggest change is still powered by sustainability. By 2025, businesses should reduce waste, eliminate some materials that are difficult to recycle and consider end-of-life at the beginning. Legacy formats are replaced by the biodegradable, compostable and recyclable packaging.

The transport produces fewer carbon emissions due to lighter structures. Household, food, and hygiene markets are now mainstream in using mono-material packs, particularly those that can be recycled using paper or film. In addition to the alternatives to multilayer plastic pouches, many companies are eliminating them and replace with the fiber based ones. The shift is being headed towards paper trays, molded pulp and pliable (mono-film) solutions. Refill tables, packaging-free units, and take-back formats are getting into the spotlight in the retail context.

It is expected that in 2025 packaging will conform to government regulations as well as the requirements of the consumer. In the environment where there are laws of extended producer responsibility, the manufacturers are reducing their use of materials and making them more recyclable.

Smart Packaging and Digital Integration

The packaging of smart products is becoming an actual reality. In 2025, the tie-in features can enhance the product safety and increase traceability, as well as provide the consumer with interactive experiences. QR codes, RFID chips, and printed sensors will follow the freshness, validate authenticity, and check the environmental situations during transport. These are tools that reduce food waste, deterr counterfeiting, and help in source to shelf transparency.

Smart indicators monitor temperature, oxygen and tamper exposure in groceries, beverages, and pharmaceutical packaging. These features are more sustainable and cost effective due to battery-free devices and printed electronics.

The packaging is as well becoming digitalised. The codes on the packages connect consumers to recycling, marketing, loyalty programs as well as usage tips. This increases the participation level and facilitates brand teaching and consistency.

Automation and Machinery Innovation

Automation is increasingly becoming a big part in design and delivery. The filling, sealing, labeling, and wrapping machines are more agile, intelligent, and quicker. The AI-based systems allow optimizing line performance, lowering downtimes, and decreasing waste of materials.

The packaging lines have robots that accelerate the work and reduce human claims. Real-time data will enable the operator to make changes in real-time due to availability or demand variation. There is also new machinery that is concerned with sustainability. The machinery that reduces the amount of film, processed thinner materials or carton capacity that minimizes the amount of nothingness has become commonplace.

As a result of the automation, the brands in this level are experiencing efficiency, increased time to market and cost effective material. The contract manufacturers and private label manufacturers would receive flexibility as they move faster between comprising product types, and pack formats.

Design Trends: Visual and Structural

In 2025, the form of packaging design is both unemotional and emotional. Flat layouts and a tactile design are not only easily noticeable but also catch the attention of users on shelves and internet shopping. Simple typefaces and the use of materials that are clean indicate environmental values. Intense colors, nostalgic visuals, and the so-called dopamine design attract impulse buyers, seeking to get fun and emotion.

There is also an interest in such creative structural concepts as refillable pods, collapsible bottles, and unusual packaging. They decrease volume, enhance usability and reuse systems. Other brands are not following format at all. Whipped-cream cans with sunscreen or snack food in beauty-style jars are an example of the packaging called chaos that attracts attention with surprise and contradiction.

Packaging Startup Innovation

Startups provide most of the innovation in the 2025. Seaweed, mushrooms, agricultural waste materials are the materials that the young companies are utilizing. Another group makes edible films, printable sensors, and refill solutions to high volume categories. Small firms are scaled using innovation issues and incubator programs.

At industry gatherings, the use of startups as a means of transformation of packaging has received industry awards, such as use of digital printing to business models focused on circularity. Big businesses collaborate with these startups to test new concepts, fill in the sustainable portfolio, and achieve their climate goals quicker. These alliances transform the supply chain packaging and promote quicker testing.

Contract Manufacturing and Out- sourcing

Proliferation of the private label and flex manufacturing models is transforming the sourcing of packaging. In 2025, increasingly, more brands are relying on contract manufacturers and packers in order to scale more quickly, mitigate risk and tap expertise.

The brands are coping with new regulations and customer trends with specialist packers. Numerous of them are currently remotely selling sustainably-sourced products with straitened lines and fulfilment all in a single place. Outsourcing opportunities give retailers such as supermarkets and other international players the agility of not investing in the long term.

Some of the recent trends in the industry have been acts of campaigns on the advantages of outsourcing to the packaging industry efficiency as well as in terms of compliance. This model has been specifically robust in the rapidly progressing areas such as health, hygiene, and foodservice.

What will it Mean to be a Brand in 2025?

The trend of Packaging Innovation 2025 is not just a trend in design, it is an element of competition. The leading brands will be those which started to invest in circular materials, automation, and digital capabilities’ integration.

In the way of food and retail, most decisions will be based on sustainability and compliance. To beauty and health, user experience and interactivity shall be more important. In any scenario, packaging should be value-creating, minimize wastage and integrate well to fit current logistics.

Whether it is a refill model and an intelligent sensor or paper trays and automated machinery powered by AI/ML systems, it appears that packaging 2025 will precondition the advent of a new approach to the delivery of products and relationships with brands.

As promised these are Part 2 of the long-form blog of Packaging innovation 2025 going into what I think will prove to be more interesting, the concrete case studies, implementation plan, and retailing applications, no citations or links, and fully in line with your standards.

Predictions in a Packaging Innovation Industry Cases in 2025

In food, beverage, beauty, and healthcare, Packaging Innovation 2025 is providing a number of quantifiable advantages in sustainability, usability, and interaction with consumers.

Food Beverage

Large brands abandon using trays made of plastic and switch to fiber based trays, pouches of paper with a compostable film, and mono material packaging film. These options save up to 60 percent of plastic, and they are useful in achieving new recycling requirements.

Even fresh produce is being sold in cardboard sleeve rather than plastic wrap. Dairy and juice producers use state-of-art aseptic bags, which are less bulky and carbon-less. Printed smart fresh sensors on the packs of fruit and dairy products enable consumers to make sure of quality any time.

Beauty And Cares

Beauty industry is seeing the trend of refillable dispensers and aluminium tubes with insertable plastic liners, and shampoo bars in pulp boxes. These are formats which react to central eco-demand and upper end positioning.

Several brands start introducing modular refill systems that allow their customers to reuse display-worthy pumps and buy only the product cartridge. Tutorials, recycling instructions, reward programs and ingredient information are accessible through a digital code.

P H & Healthcare

Security oriented packs are being improved through use of tamper evidence, temperature sensitive ink and children resisting closures capable of being recycled. Attached blister packs contain QR codes which checks authenticity and history of doses.

Homecare kits are packed in regrowable mailers that contain pre-integrated, tear-stripe and reusable, removable liner that can be discarded in a responsible manner. Single-use medical equipment is made out of eco-certified paperboard and compostable wraps which are compliant with regulatory sterilization requirements.

Blue print to the strategic implementation

In order to implement these innovations to the real world outcomes, brands and producers have adopted a four-phase roll-out plan in 2025.

Phase 1- Research & Planning

It begins by the use of lifecycle assessment tools to check on the current packaging in terms of recyclability, carbon footprint, or the impact of waste. Design workshops seek to involve R&D, marketing, and supply-chain personnel, in the identification of objectives in materials, machinery, and consumer-experience.

The trials usually start with compostable pouches, smart labels or molded paperboard. Brands also check the access regulations, particularly those involving refills mechanisms and active indicators, to prevent a hindrance in the future.

Phase 2- Pilot & Testing

The new packaging formats are released in the form of pilot programs in several regions or lines of products. The tests involve machinability trialing, shelf life tests, consumer testing and end-of-life performance.

Some of the key performance indicators are using less weight of packaging, recycled content, cost, line speed and satisfaction of the customers. Modification based on changes or improvements can be based on real time data on pilot runs.

Phase 3- Scale and integration

Effective pilots transcend between product segments and geography. New sealing, labeling, or print sensors can also be attached to packaging lines. The manufacturers frequently equip the module with mono-material conversion and reduce the amount of film under utilization.

At this point, changes to packaging are also communicated to the logistics and retail networks so that they are compatible with vending, shelf display, and shelf stocking packaging needs.

Phase 4 – Consumer Roll -Out & Feedback

Grand roll out will have a new packaging both online and in-store. The consumers are also informed through digital platforms, Qr codes and on the label, the messages relate to sustainability, recycling, and reuse.

The kind of tracking that is done post-launch checks diversion rates of the waste, clientele feeling, as well as volume of returns on the refill schemes. The lessons help in informing the future upgrading of recyclability of cartons through redesigning or even upscaling on smart-pack functionality.

Role of Retailers & Supermarkets

Retailers play a crucial part in embedding Packaging Innovation 2025 into the shopping ecosystem:

- Shelf-ready design: Optimized trays, sleeves, and dispensing formats reduce shelf handling and packaging waste at store level.

- In-store refill and return: Supermarkets are piloting refill stations for goods like cereals, oils, and detergents. Packaging-free zones and returnable containers are offering shoppers sustainable options.

- Supplier partnerships: Retailers collaborate with brands to ensure packaging meets in-store standards for machine scanning, stacking, and merchandising.

- Consumer education: PoS display units and staff awareness help shoppers understand when and how to recycle or return packaging.

Several retailers have begun rolling out standard packaging guidelines requiring 100% recyclable, compostable, or reusable formats by 2027, accelerating packaging transformation across supply chains.

Measuring Success & ROI

The benefits of Packaging Innovation 2025 are tangible and multifaceted:

- Cost savings: Lighter materials and reduced plastic lower shipping and raw material expenses.

- Brand growth: Sustainability and smart features boost consumer trust and market differentiation.

- Regulatory compliance: Brands meet extended producer responsibility requirements and future-proof against new bans or fees.

- Waste reduction: Closed‑loop or refill systems divert packaging from landfills and lower recycling costs.

- Operational efficiency: Automated lines and simplified materials speed production and cut error rates.

Metrics such as recycled content percentage, packaging weight per unit, return rate of refill packaging, and automated line throughput are used to quantify success.

Preparing for Packaging Innovation 2025

To stay ahead, brands and retailers should undertake proactive steps:

- Conduct a packaging audit to benchmark current performance.

- Map material alternatives and test mono‑material or compostable options.

- Evaluate supplier and machine compatibility for new formats.

- Pilot connected packaging labels or sensors in key SKUs.

- Partner with retailers on in‑store reuse, refill, and recycling activations.

- Plan education campaigns tied to smart packaging features or return‑holes.

- Institute success measurement tied to waste diversion and cost impact.

By following this playbook, packaging becomes a strategic asset — an avenue to reduce environmental impact, engage customers, and optimize operations via automation and digital integration.

Packaging Innovation 2025 is no longer an option; it is the benchmark. Brands that implement circular materials, digital engagement features, supply‑chain automation, and retail partnerships will define the products—and shopping experiences—of tomorrow.