Walk through any modern supermarket in 2025 and you’ll see it straight away: shelves split between the store’s own products and the big-name brands you grew up with. Some aisles look like national brands still rule the roost — flashy cereal boxes, well-known sodas, biscuits your mum bought. But look closer: more shoppers are picking up the store’s own version, tucked right beside the original.

This quiet switch — private label vs national brands 2025 — is not a passing trend. It’s a deep shift in how supermarkets protect profit and keep shoppers loyal when food prices don’t stay friendly. Some buyers see private label as a margin lifeline. Some suppliers see it as a threat that pushes them out. For shoppers? Most don’t mind, as long as it tastes good and saves a bit of money.

So who really wins in the clash: private label vs national brands 2025? Here’s the full story, without corporate waffle — just the real reasons why shelves look the way they do, who’s gaining ground, and how the best buyers balance both sides.

Private Label vs National Brands 2025: The Big Picture

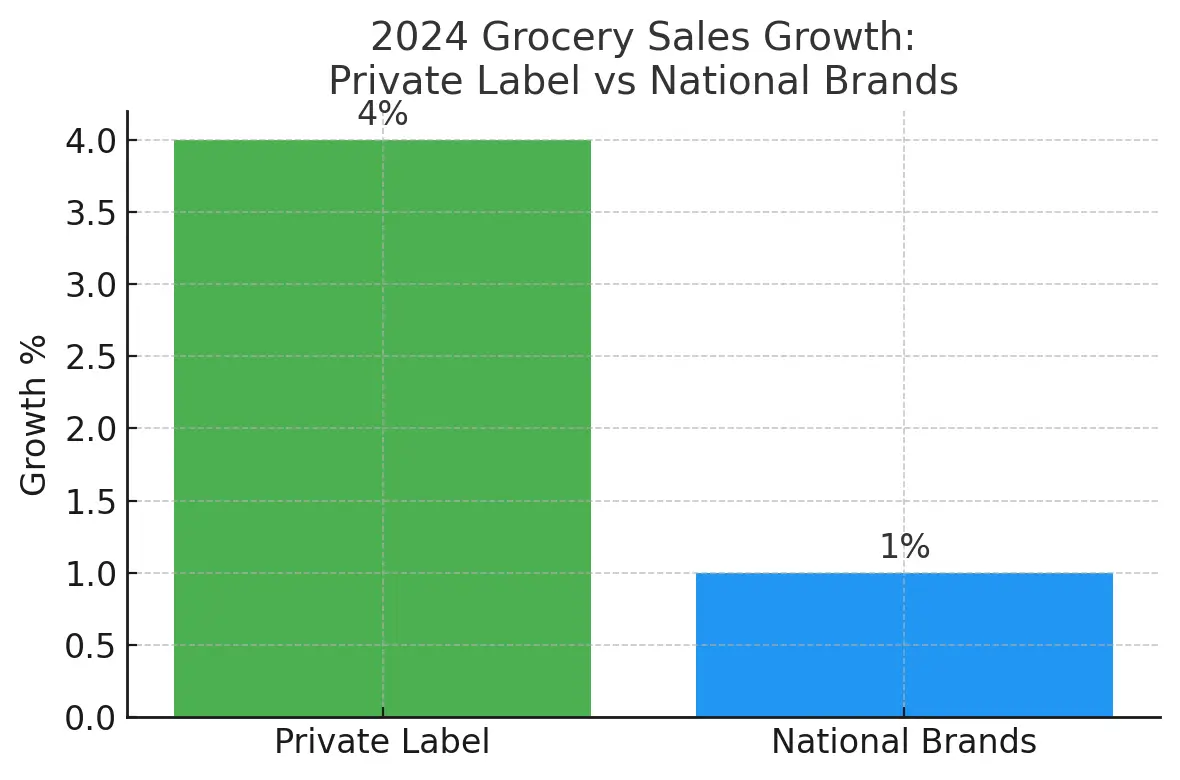

Private label — the store’s own products — has grown from cheap filler to a trusted choice. In Europe, it eats up to 50% of grocery spend in mature markets. In the US, it’s passed 20% and keeps creeping up. Asia is catching up too, as big chain stores copy Western habits.

National brands still fight back. Big FMCG companies pour millions into ads, shiny packaging and loyalty promos. They hope shoppers stay attached to familiar logos. Sometimes it works. Sometimes it doesn’t.

For supermarket chains, the maths is simple. Private label means:

More control over price.

Better margin per sale.

Fast reaction to trends.

No waiting for a big brand to launch something.

National brands mean:

Shoppers know them instantly.

Big budgets help push promotions.

Seasonal campaigns draw crowds.

Co-funded ads reduce chain costs.

In 2025, smart stores want both. They can’t lose household names — shoppers still expect to find Coke, Heinz, Oreo. But they push their own versions next to them to keep costs balanced.

Where Private Label Beats National Brands

Price

This one is easy. Store brands undercut big names by 10%–30% on average. Why? No fancy TV ads, less middleman margin, cheaper packaging.

When inflation hits, shoppers drop brands fast. Pasta is pasta if the label says so. Milk is milk. Butter is butter. Private label scoops up that switch.

Flexibility

A store brand can launch a new trend product faster than a giant FMCG. If data shows shoppers want high-protein yogurt or gluten-free snacks, the chain can test a house line in weeks.

A national brand has layers of approval, global supply chains, and big marketing rollouts. It’s slower, riskier.

Control

Stores control supplier deals for their own products. They can switch factories, source local, tweak pack sizes to fit shelf gaps. It’s harder to push a global brand to change.

Margin

Each store brand unit makes more profit per pound or dollar than a branded one. It’s the simple reason buyers love private label. Same basket size, better bottom line.

Where National Brands Hold Strong

Trust on Premium

In many categories, national brands still beat store versions for reputation. Think chocolate, baby formula, beauty items. Some shoppers trust well-known brands for quality or safety.

Impulse Buys

Big brands spend billions to keep the product top-of-mind. In checkout aisles, seasonal end-caps and snack racks, impulse branded treats win.

Innovation Budget

Some FMCG giants fund huge R&D labs. They bring breakthrough products: new soft drinks, functional snacks, supplements. Store brands copy fast but rarely invent first.

Marketing Muscle

Super Bowl ads. Olympics sponsorships. Local festivals. National brands stay visible. Store brands rarely advertise on that scale.

Private Label vs National Brands 2025: Discounters Flip the Script

No one does private label better than discounters. Aldi and Lidl fill shelves with 80–90% own lines. They don’t ask shoppers to choose between a big brand and their version — they mostly don’t offer the big brand at all.

This pure model slices costs and makes supply chains tight. It’s also why Aldi’s share keeps growing in the UK, Ireland, Spain and creeping into the US heartland.

Traditional supermarkets can’t copy it fully — shoppers still expect big brands too — but they copy pieces: budget lines, minimal packaging, value packs.

Shoppers: Do They Care?

Truth is, most don’t. In blind taste tests, many can’t tell own label from brand on basics like pasta, bread, milk, and canned goods.

Where they do care: chocolate, biscuits, coffee. A trusted brand feels safer. But even there, premium store brands close the gap each year.

In 2025, the cost-of-living crisis left a dent. Price trumps loyalty more often. Store apps push multi-buy deals on own brands. Checkout receipts highlight savings. It all trains shoppers to switch.

How Buyers Balance Both

A smart buyer doesn’t ditch brands or worship store labels blindly. They mix both, shelf by shelf.

Best practice in 2025:

Use private label to set a floor price. Big brands must justify the higher cost.

Push store brands for staples. Add premium store lines for margin.

Keep iconic brands for trust. Nobody wants to see Coke missing.

Cross-promote. Multi-buy a branded drink with a store snack.

Study data weekly. Spot switch trends fast.

When a brand underperforms beside a strong store version, buyers shrink its shelf space. It’s ruthless but fair.

Supplier’s Dilemma: Friend or Foe?

Many suppliers hate private label… until they realise it can pay the bills.

Some big food factories run national brand orders by day and store brand runs by night. Same plant, different box.

Private label contracts mean stable volumes. No branding costs, no consumer marketing. But price pressure is brutal. Miss a deadline or slip on quality? The store switches factories.

Smart suppliers play both sides: nurture the brand, court private label. It spreads risk. If the branded line loses shelf space, the private label keeps the lights on.

Online Shelf: Quiet Power Moves

Online grocery changed this fight too. A website shows shoppers a neat grid. Stores place their own brand first. Search results push the value pack or own label bundle.

Few shoppers scroll far. If the store version looks fine, they add it. No bright brand packaging fighting for attention.

Apps show reminders: “Switch to save £1”. Loyalty perks sweeten the deal.

In a real shop, brands have seconds to stand out. Online, private label steals the spotlight.

Private Label vs National Brands: Regional Highlights

Europe: Discounters lead. Aldi, Lidl, and local chains keep national brands under tight margin checks. Private label share 35–50% in top markets.

USA: Catching up. National brands still strong in snacks, drinks, cereals. But store lines grow fastest in household, dairy, pantry basics.

Asia-Pacific: Urban chains add private label for daily needs — rice, cleaning supplies, fresh packs. National brands hold premium snack and health products. Trust gap smaller every year.

Innovation: Who Does It Best?

National brands still lead for big breakthroughs. Think new plant-based burgers, functional drinks, sports nutrition blends.

Private label wins on speed: copy fast, test in small batches, scale overnight. They spot winning trends in branded lines, then match or tweak at lower price.

What to Watch in 2025

1. Premium Store Brands:

More top-tier store lines. Fancy packaging, new recipes, holiday ranges. Margins keep rising here.

2. Sustainability:

Retailers push greener store lines first. Easier to control than chasing big brands for change.

3. Data and Loyalty:

App data tracks who switches brands vs own labels. Smart promos push the next switch.

4. M&A Impact:

Big brands merge to cut cost and defend shelf presence. Retailers merge too — scale boosts private label power.

At a Glance

| Region | Private Label Share | Brand Strongholds |

|---|---|---|

| EU | 35–50% | Confectionery, premium drinks |

| US | 20–25% | Snacks, carbonates, cereals |

| APAC | 10–20% | Health & wellness, prestige lines |

Private Label vs National Brands 2025: Bottom Line

This is no passing storm. Store brands are a strategy, not a filler. They keep profit inside the chain, lock shoppers into loyalty perks, and remind brands who’s boss.

National brands won’t vanish. But they fight harder, spend smarter and squeeze suppliers more each year to protect their slot.

For buyers, the balance is the skill. Too much own label and shoppers miss the big names. Too much brand loyalty and the discounters steal the price-conscious crowd.

For suppliers? Adapt or get squeezed out. Private label will grow either way — the only question is who supplies it.