These days, supermarkets know more about their customers than ever before — not by guessing, but by watching real habits in real time. Each scan at the till, each tap in a shopping app, each loyalty point claimed feeds a smart engine behind the scenes. This is retail shopper analytics: the everyday data workhorse that quietly decides what fills the shelves, when discounts land, and how to tempt shoppers to spend a bit more, just when they’re ready.

In 2025, retail shopper analytics is not just a buzzword for head office IT teams. It’s the heartbeat of every smart supermarket’s daily game plan. For buyers, it’s about squeezing more margin from every shelf metre. For suppliers, it’s about proving their products deserve to stay. For advertisers, it’s about catching shoppers’ attention at the exact second they’re ready to spend.

So what does this mean for the real people reading this? How does retail shopper analytics work? How deep does the data go now — and how do chains turn numbers into real profit?

Let’s break it down, simply.

What Is Retail Shopper Analytics?

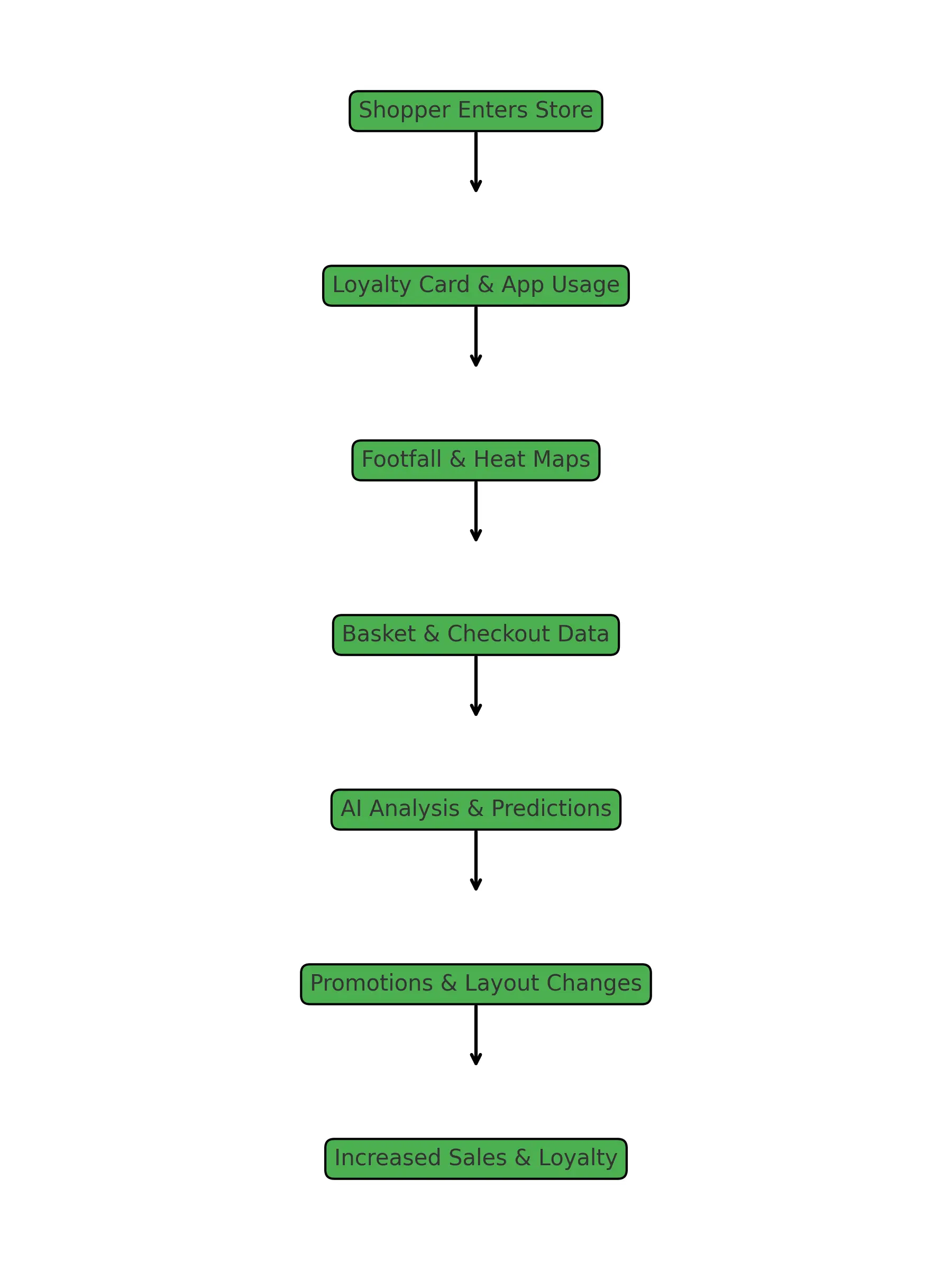

Put simply, it’s collecting and analysing everything shoppers do, say or touch in-store and online. Loyalty cards were just the beginning. In 2025, supermarkets blend:

-

Trolley and basket scans

-

Self-checkout logs

-

Click-and-collect orders

-

Mobile app usage

-

Store footfall counters and heat maps

-

Social media sentiment

-

Supplier scan-back data

The goal? Spot patterns. Predict what people will want next week. React fast if a brand is losing out to a cheaper rival. Plan shelf resets, spot dead zones in a store, push promotions when footfall dips.

It’s data with one aim: make people spend more, more often, with less wasted stock.

How Shopper Analytics Grew Up

Twenty years ago, analytics meant yesterday’s sales report and maybe a Clubcard points file on a spreadsheet. Then Tesco and Sainsbury’s pushed loyalty cards to map exactly who buys what and when.

Fast forward to now: Tesco’s data spin-off Dunnhumby still leads the field. Kroger in the US does similar — its Plus Card fuels supplier deals and targeted coupons. Walmart takes a lighter loyalty path but mines massive scan data daily. Even Aldi, known for minimalist stores, quietly tracks category velocity to trim or expand lines with military efficiency.

Retail shopper analytics has grown from ‘nice to know’ to ‘must know’. With prices yo-yoing, shoppers more flighty, and discounters keeping everyone honest, ignoring data is asking for lost share.

Key Tools in 2025

1. Loyalty Cards & Apps

Still king. They tie every basket to a real household. Buyers know who stocks up big on payday, who cherry-picks discounts, who splurges on premium.

2. Footfall & Heat Maps

Ceiling sensors and cameras show where shoppers slow down and what they skip. This feeds store layout tweaks. Cold aisle dead zones get new ends. Busy areas gain high-margin promos.

3. Basket Analysis

Every scan reveals basket pairs — who buys wine with cheese, who buys nappies with snacks. This sets up cross-promos that feel like magic.

4. Online Browsing & Abandoned Carts

Apps and websites track search terms, wish lists, and forgotten baskets. Targeted push offers rescue some sales.

5. AI & Predictive Models

The new push: not just reporting what sold, but predicting what will sell, and nudging shoppers to act.

How Buyers Use Retail Shopper Analytics

If you buy stock for a supermarket, you live in reports. But modern reports are smarter. They don’t just show you how baked beans did last month — they flag if premium tomato sauce is stealing share.

Range reviews now pair hard sales with loyalty segments: are middle-income shoppers trading down to budget brands? Is that new vegan range just a fad in London postcodes, or should it scale nationally?

Promo planners study elasticity: how deep does a discount need to be before volume pays back margin loss? Retail shopper analytics answers that daily.

Store managers get simpler dashboards: which aisles need a tidy, which items are hot at 7pm vs 10am? It makes shelf-filling more precise.

How Suppliers Plug In

For FMCG suppliers, shopper analytics is both friend and foe. Friend because good data proves a product deserves more facings. Foe because chains use data to squeeze harder deals.

Smart suppliers pitch with facts: “Our snack drives 40% basket uplift when bought with your store-brand juice.” Or they co-fund loyalty perks: “Buy three, get a bonus — we pay half.”

Big brands sometimes get weekly dashboards directly from retailers’ data teams (or via partners like NielsenIQ). This avoids guesswork about performance and shows clear ROI to marketing managers.

Shopper Analytics in Action: A Simple Scenario

A simple real-world example: it’s mid-January. Data shows shoppers trade down from premium brands after Christmas. Basket scans reveal more own-label products creeping in. Buyers spot it fast — so they roll out a value multi-pack in biscuits and push a loyalty app coupon for store-brand tea.

Two weeks later, category share stabilises, margin holds, and the brand supplier realises they need to run an ad campaign or lose shelf space next range reset.

Without retail shopper analytics, this tiny shift might be invisible for a whole quarter. Now it’s tackled in days.

Big Trends for 2025

AI Everywhere

Supermarkets invest heavily in AI that learns fast: forecasting, personalising offers, predicting weather impact. It’s not sci-fi — it’s normal now to see a chain reprice items daily to stay competitive.

Real-Time Personalisation

Apps push ‘just for you’ offers at checkout. E-receipts suggest what to buy next time. Loyalty apps send birthday perks or Friday night snack deals, all powered by shopper history.

Privacy & Trust

More countries tighten data laws. Shoppers demand clear opt-outs and easy data download options. Smart chains find a balance: data goldmine vs public trust.

Cross-Channel Consistency

In-store and online must sync. Price mismatches annoy loyal shoppers. Retailer analytics teams bridge the gap with unified dashboards.

Regional Differences

UK & Europe

Tesco, Sainsbury’s and Aldi keep pushing loyalty data deeper. Discounters test card-lite versions, balancing simplicity and insight.

US

Kroger’s loyalty strength is a big edge. Walmart prefers massive transaction scraping. Club stores like Costco rely more on membership than deep basket profiling.

Asia-Pacific

Super apps merge grocery orders with lifestyle shopping. Shopper data crosses over to banking offers and food delivery perks.

Challenges: Data Mountains

Having a million data points doesn’t help if teams drown in dashboards. Chains invest in clear reports, smart alerts, and staff who translate data to clear actions.

Training is a big gap. Some old-school buyers resist over-analysis. Leading stores mix human gut feel with data truth.

What Buyers Should Do Now

-

Check weekly reports, not quarterly.

-

Use basket data to build new cross-sells.

-

Spot trends early — trade up, trade down, brand switch.

-

Work closer with suppliers to co-fund loyalty perks.

-

Keep store teams trained: local managers can fix layout dead spots fast.

What Suppliers Should Do Now

-

Ask for data sharing in contracts — or buy third-party panels.

-

Bring data to buyer meetings. Show basket uplift and loyalty lift.

-

Pitch trials backed by shopper segments — not gut feel.

-

Fund smart discounts, not blanket promos.

-

Watch online ratings and reviews — today’s loyalty card is also word of mouth.

Quick Stats: Retail Shopper Analytics at a Glance

| Metric | Typical Range (2025) |

|---|---|

| Loyalty card penetration | 60–80% in mature markets |

| Average private label uplift with basket pairings | +15–30% |

| Footfall data use for planogram tweaks | Weekly in top chains |

| In-store app push offers | 2–5 per visit for active users |

| AI forecasting accuracy (near-term) | 85–95% for core items |

Final Word: Retail Shopper Analytics in 2025

Shopper analytics won’t shrink. Shoppers expect good value. Buyers must protect margin. Suppliers need to fight for space in crowded aisles. Data glues it all together.

Smart supermarkets make data invisible for the customer — but vital for every deal, shelf, promotion and pricing tweak.

Ignore it, and competitors with better insights will spot what you miss.

This is retail shopper analytics 2025: messy, fast, relentless — and profitable when done right.