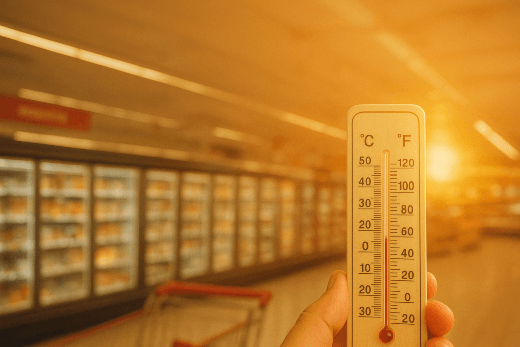

Britain’s fourth heatwave of the year is straining supermarket supply chains and raising the risk of food recalls, especially among chilled own-brand products that now make up more than half of grocery baskets.

The UK Health Security Agency has amber heat-health alerts across much of England, with temperatures climbing into the mid-30s. On 11 August 2025, UKHSA and the Met Office issued amber alerts for areas including the West and East Midlands, London, the South East and East of England, as temperatures reached the mid-30s °C.

The Met Office has warned that such extremes are no longer rare, with climate volatility bringing longer hot spells and tighter pressure on transport, storage, and energy costs.

Refrigeration Under Pressure

Cooling systems are already one of the biggest drains on supermarket energy use. Studies show refrigeration can account for up to 50% of a store’s total electricity, and during a heatwave the figure can spike sharply.

Analysis by the Grantham Research Institute at LSE has documented how extreme temperatures significantly elevate energy demands in refrigeration systems.

During the July 2022 heatwave, one major UK retailer reported chilled display failures at a dozen stores and a 20% jump in daily power bills. Similar incidents are resurfacing this summer, with regional grocers in the Midlands and South East telling GSN that depot refrigeration units have been running “at red line” for days.

Dr Paul Coleman, public health consultant at UKHSA, confirmed that amber heat-health alerts covering regions such as London, the South East and Midlands were in force this month, underscoring the pressure on chilled logistics.

That kind of strain raises the chance of food spoiling before its expiry date. Dairy, ready meals, meat, and bagged salads — categories where private label dominates — are most exposed. A single cold-chain breach can quickly force products off shelves in multiple locations.

Which Supermarket Products Fail Fastest in a Heatwave?

Milk is often the first casualty. The Food Standards Agency noted in past summers that souring complaints rose within 24–48 hours of heat alerts, even for cartons still inside their “use by” date.

Leafy salads follow. In July 2022, Morrisons was forced to discount large volumes of bagged greens when temperatures topped 35°C, as shelf-life dropped sharply. Ready-to-eat sandwiches and pre-cut fruit — high in moisture and handled multiple times before reaching shelves — are also vulnerable.

The common link: these are almost all supermarket own-label staples, meaning every recall is tied directly to a retailer’s name.

Why Private Label Recalls Hit Retailers Hardest

Private label chilled ready meals and fresh meat now make up more than 60% of sales in Tesco and Sainsbury’s, according to Kantar. Aldi and Lidl depend on own-label for over 80% of their ranges.

Unlike Coca-Cola or Nestlé, which manage their own logistics, many supermarket-label suppliers rely on smaller contract manufacturers and third-party distribution. That leaves them exposed when refrigerated lorries stall in traffic or depot systems falter.

“With own-label, accountability doesn’t transfer — it stops at the supermarket’s logo,” one senior retail analyst told GSN. “A branded recall dents a supplier. A private-label recall dents the supermarket.”

Financial and Operational Fallout

Weather volatility is already affecting grocery sales. In July, Greggs reported that hot food demand fell during peak heat, showing how consumer behaviour shifts with temperature. For chilled categories, the risk runs deeper: spoilage leads not only to recalls and waste but also to insurance claims and contract disputes.

Retailers are tightening their private-label supply contracts. Penalties for late or poorly refrigerated deliveries are now common, with several chains trialling AI-based temperature logging in lorries. Smart packaging that signals freshness in real time is also being tested, particularly for high-risk salads and poultry.

Consumer Trust on the Line

Private labels are both a profit driver and a differentiator. UK supermarkets rely on their own ranges for margins and loyalty. But repeated recalls in a summer of heat alerts could erode confidence, nudging shoppers back to national brands seen as safer.

For now, analysts warn that every delay or cold-chain failure magnifies the risk. Food spoilage during heatwaves is no longer an abstract possibility but a daily operating challenge for grocers facing climate volatility.

GSN analysis: Supermarkets built their margins on private label growth. In a season of recurring heatwaves, that strength could become their most visible weakness.